TOTVS/DIMENSA Financial System

Overview

The product ecosystem encompasses financial solutions for credit management, card operations, and core banking. It supports end-to-end banking processes such as credit origination, card lifecycle management, financial parameterization, and operational workflows. Designed to handle complex regulatory, operational, and transactional scenarios, the platform provides a scalable and integrated foundation for financial institutions to manage their core services efficiently and securely.

My Work

As a UX Designer and Information Architecture lead, I conducted user research, mapped financial workflows, and designed intuitive interfaces for high-complexity banking processes. I developed prototypes, validated solutions with users, and collaborated closely with engineering teams. I also created and maintained interface standards and contributed to the governance and evolution of the Design System to ensure consistency and scalability across products.

Design Procresso

My UX process was structured to address the specific demands of the financial sector—ensuring consistency, security, scalability, and a user-centered experience.

- Discovery and understanding of the financial domain

Each project began with a deep dive into business rules and stakeholder needs, involving product, engineering, compliance, and banking operations teams. I mapped complex financial flows—such as credit origination, parameterization, card onboarding, and core banking integrations—to establish clarity and alignment across areas. - User research and requirements analysis

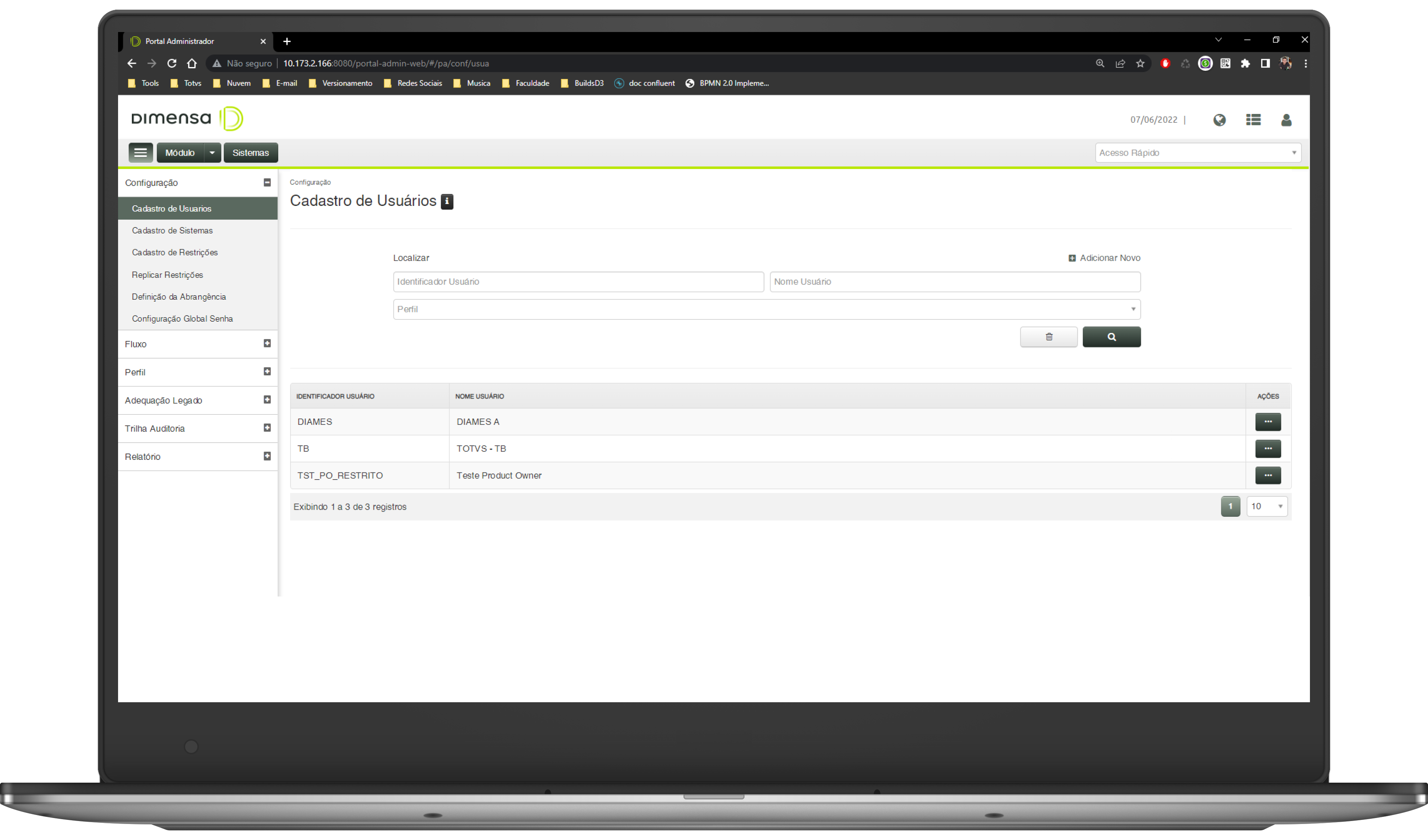

I conducted interviews with internal users (analysts, managers, and operational teams) as well as representatives of end-clients to uncover behaviors, pain points, and opportunities. I combined qualitative insights with product data analysis to prioritize features and identify friction points in existing journeys. - Information architecture and pattern definition

I led the structuring of flows, taxonomies, and mental models that organized the navigation of financial systems in a clear and scalable way. In parallel, I was responsible for creating and evolving interface patterns and guidelines, contributing to the foundation of a Design System tailored to the financial ecosystem.

This ensured consistency across modules, reduced rework, and accelerated development. - Ideation, prototyping, and validation

I translated research findings and requirements into low- and high-fidelity prototypes, exploring multiple solutions for critical journeys—from credit approval flows to card management and banking configurations.

I conducted usability tests with real and internal users, iterating quickly to validate hypotheses and ensure alignment with operational, regulatory, and user experience needs. - Delivery, documentation, and collaboration with engineering

I worked closely with development, QA, and product teams, providing detailed documentation of behaviors, interactions, and Design System components.

This ensured clear, traceable, and standards-aligned handoffs, reducing inconsistencies during implementation. - Continuous improvement and Design System governance

Beyond day-to-day product deliveries, I contributed to the governance of the Design System, defining usage criteria, scalability, and update processes. My role involved evaluating new component needs, incorporating improvements, and ensuring the ecosystem remained cohesive and sustainable over time..

If you want more information about the Product, visit the official website by clicking here.